New Local Plan: Spatial Options Document 2021

Town Centres and Retail

Town Centres and Retail

Relevant Plan Objectives: 7, 8

The District's town centres of Rayleigh, Rochford and Hockley, along with local and village centres, are fundamental to everyday life for most residents and businesses, and are important contributors to local economy, community and identity. They provide a wide range of both everyday (convenience) and specialist (comparison) retailers, in addition to food & drink, leisure, entertainment and service business, office accommodation; and key public facilities (e.g. healthcare, libraries and council services).

The NPPF states in Chapter 7 that planning policies should support the role that town centres play at the heart of local communities, by taking a positive approach to their growth, management and adaptation. Planning policies should:

- define a network and hierarchy of town centres and promote their long-term vitality and viability – by allowing them to grow and diversify in a way that can respond to rapid changes in the retail and leisure industries, allows a suitable mix of uses (including housing) and reflects their distinctive characters;

- define the extent of town centres and primary shopping areas, and make clear the range of uses permitted in such locations, as part of a positive strategy for the future of each centre;

- retain and enhance existing markets and, where appropriate, re-introduce or create new ones;

- allocate a range of suitable sites in town centres to meet the scale and type of development likely to be needed, looking at least ten years ahead. Meeting anticipated needs for retail, leisure, office and other main town centre uses over this period should not be compromised by limited site availability, so town centre boundaries should be kept under review where necessary;

- where suitable and viable town centre sites are not available for main town centre uses, allocate appropriate edge of centre sites that are well connected to the town centre. If sufficient edge of centre sites cannot be identified, policies should explain how identified needs can be met in other accessible locations that are well connected to the town centre;

- recognise that residential development often plays an important role in ensuring the vitality of centres and encourage residential development on appropriate sites.

Town centres and local centres play an important role in supporting vibrant and prosperous local communities. Town centres need to be multi-functional offering the right balance of comparison and convenience shopping, hospitality and leisure, community and civic facilities and residential. It must be recognised that retail-dominant town centres are struggling in light of ongoing structural changes happening in high streets and town centres across the country. As a result, a key determinant of 'successful planning for our local town centres will be their ability to adapt to new trends, technologies and practices, maintaining vibrancy in the face of change.

Town centres and local centres play an important role in supporting vibrant and prosperous local communities. Town centres need to be multi-functional offering the right balance of comparison and convenience shopping, hospitality and leisure, community and civic facilities and residential. It must be recognised that retail-dominant town centres are struggling in light of ongoing structural changes happening in high streets and town centres across the country. As a result, a key determinant of 'successful planning for our local town centres will be their ability to adapt to new trends, technologies and practices, maintaining vibrancy in the face of change.

The Coronavirus pandemic has had a catastrophic effect on the UK retail and leisure industries, with a series of restrictions resulting in enforced closures for most retail and leisure businesses, along with additional costs and capacity restrictions as and when businesses have been permitted to operate. At the same time and as a consequence, demand for online retail has jumped considerably. The impact on retail and leisure has been severe, with the first half of 2020 seeing a net loss of 7,834 retail units, the highest on record, with national chains particularly hit. The pandemic is expected to accelerate ongoing trends of certain traditional town centre uses moving to online services, including banks and comparison retail. There is, however, some evidence that local town centres such as those in the District have seen less of an impact in terms of footfall and vacancies than larger cities and shopping centres, reflecting both a preference to shop locally and the trend away from commuting towards home-working.

It is important, however, to recognise that town centres were under considerable pressure prior to the pandemic, due to both growth in online retail and competition from out of town retail parks, shopping centres and supermarkets, with retail parks in particular having experienced lower vacancy rates in recent years. Town centres across the country are therefore being re-imagined away from retail-led approaches towards more mixed-use approaches that see a greater proportion of food & drink, leisure, residential and community uses. These 'experiential' uses, along with services such as hairdressing and beauty, are more resilient to online shopping trends and can help drive wider footfall.

It is also important to recognise that the planning tools available to local authorities to influence the use of town centres are evolving with changes to planning legislation. The introduction of a new Use Class E has seen the consolidation of traditional town centre use classes A1, A2 and A3 (retail, professional/financial services and restaurants/cafes respectively), B1 (office and light industrial) and aspects of D1/2 (community uses) into a new single Use Class E, with planning permission not required to change the use of a building between any of those uses. Whilst the flexibility provided by the new Class E may help town centres become more resilient and adaptable, with entrepreneurs able to readily convert vacant units for new purposes and thus reduce vacancy rates, it introduces a challenge for Local Plan policies to promote or restrict particular uses in town centre or to prevent a clustering of certain types of undesired uses. This change, combined with the introduction of expanded permitted development rights which will allow Class E buildings to become homes without the need for planning permission, further restrict the scope of town centre policies to promote and restrict particular uses with town centres. This presents both opportunities and challenges for town centre planning, with increased levels of housing potentially increasing footfall for town centre businesses and making such places more vibrant and sustainable, but a lack of restrictions also risks the loss of important town centre businesses where residential development is likely to provide greater returns for the landowner.

The South Essex Retail Study 2018 (SERS) is a key piece of evidence that assesses current retail and leisure provision across the District, and calculates, based on expenditure and housing growth projections, how much additional space may need to be developed to provide the local population with a full range of shops and services they require. Over the next 20 years, Rochford District is estimated to need an additional 5,179m2 of comparison retail space, and 1,077m2 of convenience retail space as population and annual retail expenditure in the District grows. In addition, there is potential for an additional £40m of food and drink expenditure to be provided for, meaning a sizeable potential requirement for further food & drink space.

The figures above indicate a longstanding trend within the District in which development of retail and leisure space has not kept up with population growth which has led to only more basic needs being accommodated locally, whilst the need for more complex uses (e.g. larger supermarkets, premium restaurants or cinemas) has been met by residents travelling elsewhere. This is reflected in the study, which indicates the potential for a niche cinema offer and further food & beverage provision alongside future housing growth.

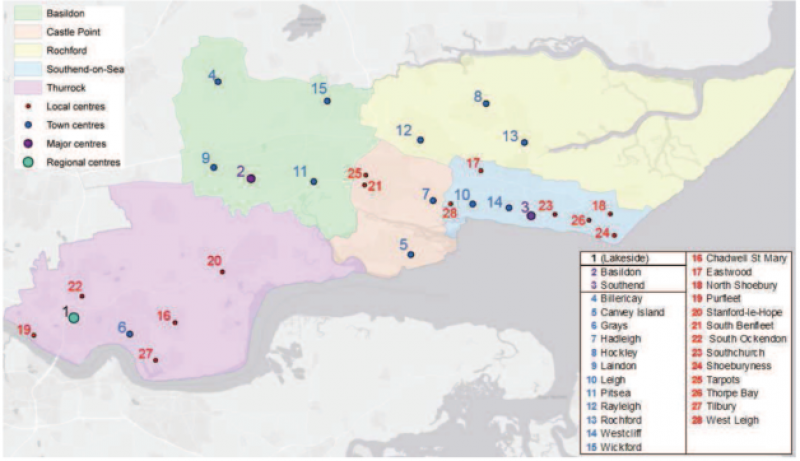

As set out in the Study, Rochford District has one of the highest 'leakage' rates for residents travelling elsewhere for retail needs across South Essex, with 68% of residents going elsewhere for comparison shopping and 57% for convenience. Similarly, for food and drink leisure, the leakage figure is 33%. This is unsurprising, given the proximity of major centres such as Basildon and Southend, but does indicate additional potential for retail and leisure space within the District and a retention of a greater amount of retail and leisure spend.As indicated above, Rochford is not self-sufficient in terms of retail, and sits within the context of wider South Essex retail area, with residents travelling to other local and regional centres for shopping and services, whilst the District's centres in turn attracts residents from other areas to visit and shop. The SERS categorises South Essex centres by importance, from Regional (e.g. Lakeside Shopping Centre), through to 'Major' (e.g. Basildon and Southend), 'Town' and 'Local' centres, with the map below plotting these. Rochford, Rayleigh and Hockley are all identified as 'town centres', however the absence of major or regional centres underlines Rochford's relatively minor role in relation to retail provision across the wider South Essex sub-region.

National policy encourages plans to identify town centre hierarchies, with those centres at the top of the hierarchy those that are the most important for retail and leisure provision. Figure 36 below illustrates a local hierarchy for Rochford.

|

Hierarchy |

Centres |

|

Town Centres (Protected) |

There are 3 town centres in Rayleigh, Rochford and Hockley which house over 30 businesses |

|

Local Centres (Unprotected) |

There are a small number of local centres, including Hullbridge, Great Wakering and Golden Cross which serve local populations |

|

Local Parades (Unprotected) |

There are large number of local parades throughout the District, generally located in suburban areas |

Figure 36 – Retail Hierarchy

Figure 37 – Hierarchy of Centres in South Essex (South Essex Retail Study, 2017)

The Core Strategy, through policies RTC1-6, follows prevailing national policy in encouraging retail and leisure uses to concentrate in the District's established town, village and neighbourhood centres, adopting a sequential test to restrict out of town development. Dedicated Area Action Plans (AAPs) were adopted in 2014 for Rayleigh, Rochford and Hockley, with these seeking to protect and enhance each town's role as a retail centre, whilst promoting other uses and interventions to support their general vitality. In considering the District's future retail and leisure needs, it is useful to consider each of the District's main centres in turn, including their role in the context of the District and wider area, and whether the current AAPs have delivered the anticipated change.

Rayleigh

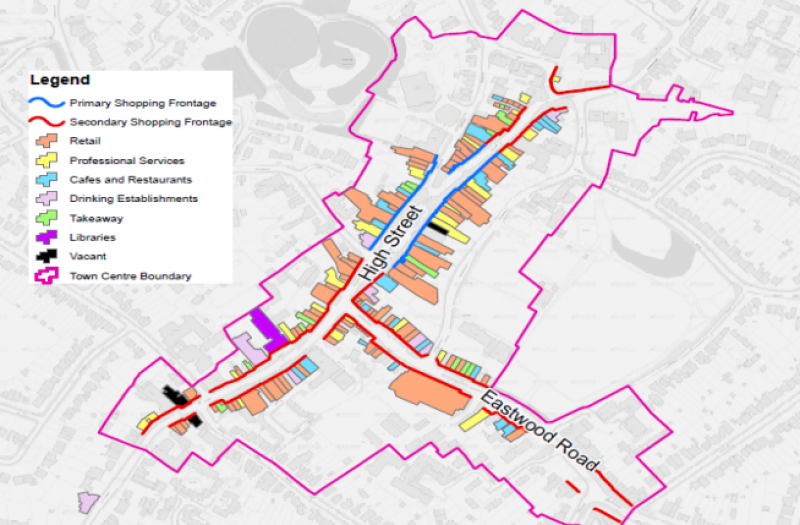

Rayleigh is a market town and the District's principal shopping destination. The SERS noted its wide comparison and convenience offer, which serves the town and the surrounding villages. It is ranked 716th nationally, according to the Javelin Research VENUESCORE system of ranking retail centres in terms of their offer. Rayleigh's AAP sought to strengthen the town's role as the District's primary retail centre, promoting the consolidation of retail along the High Street, along with promotion of town centre-appropriate uses (i.e. A2-5, leisure and cultural/community) in the surrounding streets. It also prioritised intensification of key sites for mixed-use development and a series of public realm, highways and cycle/pedestrian improvements, to ease access around the town and tackle longstanding congestion issues.

Figure 38 – Rayleigh Town Centre Use Class Mapping (2020)

In 2021, Rayleigh continues to be the District's main retail hub, with a February 2020 assessment of ground floor uses along Government-approved 'health check' principles indicating the town centre continues to be well-occupied, with a good proportion of A1 retail uses (both comparison and convenience), strong mix of supporting A2-5 uses and low vacancy rate (see map below). It is recognised that the Coronavirus pandemic has lead to a small increase in vacancies since this mapping was prepared, including the prominent former Dorothy Perkins store.

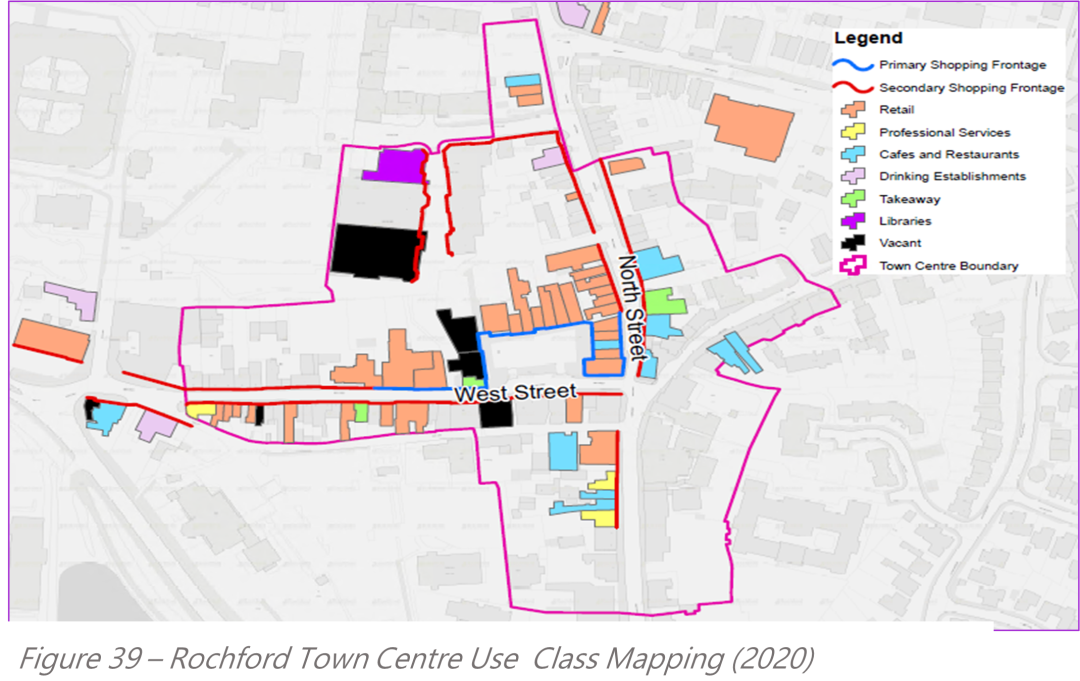

Rochford

Rochford is a small market town with relatively high proportion of convenience floorspace reflecting its position in the retail hierarchy, Rochford has a localised catchment that includes the surrounding rural villages. Its national VENUESCORE ranking is 2,577 reflects it is considerably smaller than Rayleigh. The Rochford AAP prioritises the concentration of retail and supporting uses around the historic market square, West Street and North Street, whilst proposing a range of public realm, highways and connectivity enhancements to support the historic core and attract visitors, including pedestrianisation of the market square. It also supports a stronger evening economy through encouraging appropriate uses, and intervention on key underused/unattractive sites to improve the overall built environment and support town centre vitality. Since the AAP's publication, there has progress in some areas, including proposals to develop the former police station and underused space behind the Freight House, a historically-sensitive residential scheme on East Street proposals to redevelop the key arrival point on the junction of West Street and Union Lane. There has been more limited progress in other areas, with a 2019 Health Check carried out by Lichfields finding high vacancy rates of 14.5%, higher than previous surveys undertaken in 2008 and 2014, and above the national average of 11.8%.

Although work has commenced since the health check on some prominent vacant buildings (e.g. the conversion of the former Barclays Bank at 15 West Street into a pharmacy, and the former NatWest Bank at 32 West Street into office suites), the issue of vacant units remains considerable, typified by a longstanding empty former supermarket unit. In addition, the closure of 2 public houses since 2017 suggests that efforts to enhance the town's retail and leisure role have not advanced either. The map below indicates the prevalence of vacant units in Rochford Town Centre in 2019. Similarly, proposals to enhance the public realm of the market square and introduce connectivity improvements are yet to proceed. As with Rayleigh, the impending redevelopment of a number of Council assets may enable regeneration objectives to be met, but may necessitate a revisiting of policies to create a more sustainable long-term mix of uses in light of the structural issues covered in this section.

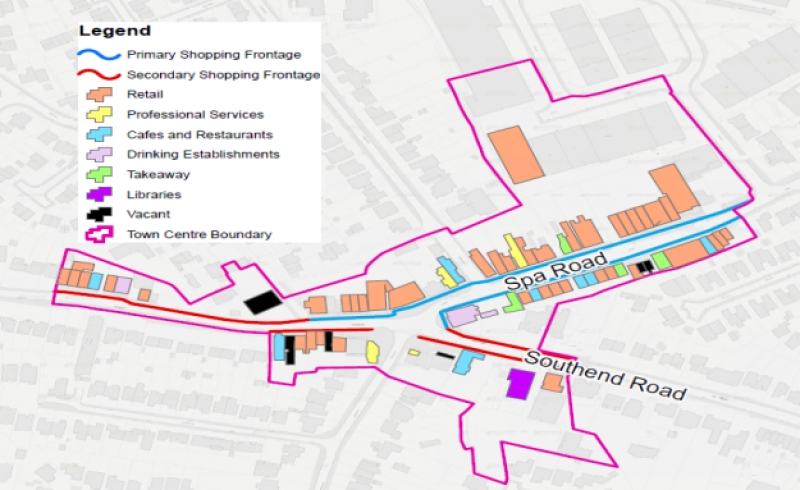

Hockley

Hockley provides a smaller centre, described by the SERS as serving a largely localised catchment area, and as such does not have a VENUESCORE rank. Hockley hosts a number of important convenience retail, service and food & drink/leisure uses, and Hockley AAP identifies its adjacent Eldon Way Industrial Estate as being an opportunity site, due to its potential for mixed-use development. Combined with a location close to a railway station, Hockley Town Centre has considerable potential to support new residential, business, retail and leisure uses. The AAP envisages a Hockley combining enhanced retail for the local community, the mixed-use redevelopment of Eldon Way to deliver housing, town centre uses and public realm on previously developed land, and the retention of some employment uses. Some progress has been made through the opening of an additional convenience retail store (Sainsburys) to complement the existing Co-Op and Costcutter supermarkets, and vacancy rates are healthy. However, the key component of Hockley's transformation remains unachieved, with Eldon Way remaining as an industrial estate with a high proportion of leisure uses, and poor connectivity with the wider town centre persisting.

Figure 40 – Hockley Centre Use Class Mapping (2020)

Outside the three main town centres, it is important to acknowledge the District's other retail centres, each of which will require careful planning to ensure they support a long-term sustainable and balanced mix of uses.

- Southend Airport Retail Park – the District's main out of town retail centre, with a range of comparison retailers, e.g. homeware, furniture, pet supplies. It has a VENUESCORE rank of 1,709, and is a significant draw, despite only being accessible from Southend Borough.

- Village centres and neighbourhood shopping parades, such as Great Wakering; Hullbridge; Golden Cross; Eastwood Road; Southend Road; Grove Road; London Road; and Hullbridge Road. These centres fulfil important local roles, primarily for convenience retail, services (e.g. hairdressing) and food & drink. new housing development has the potential to benefit businesses in such centres.

- Industrial estates, garden centres and farm sites: although not formally allocated, the District's industrial estates host a number of retail and leisure uses, whilst garden centres and former nurseries within the Green Belt house others. Such sites fulfil a demand, but require careful planning to avoid exacerbating existing issues around traffic congestion, parking and environmental impact.

OPTIONS - A number of non-exclusive options for addressing town centre and retail needs through the plan include:

- Producing new dedicated masterplans or area action plans for Rayleigh, Rochford and Hockley, updating these to reflect local and national changes and providing a new positive vision for uses within these centres

- Incorporating specific town centre policies for Rayleigh, Rochford and Hockley within the new Local Plan, reflecting local and national changes and providing a new positive vision for uses within these centres

- Continuing to define boundaries, primary and secondary retail frontages for each centre and developing a policy approach that restrict appropriate uses within each type of frontage

- Continuing to define primary and secondary retail frontages for each centre but allow the market to determine the most appropriate uses for those frontages within Class E

- Encouraging a greater quantity of housing within centres in support of Strategy Option 1: Urban Intensification (including using the brownfield register to define sites in town centres that are considered generally appropriate for residential development)

- Ensuring any large-scale new housing or employment developments create new neighbourhood centres to serve them, or alternatively provide for sustainable connections to existing centres

- Allocating land with town centres or other appropriate locations for new retail and leisure developments

- Restricting out-of-town retail and leisure development unless it can be demonstrated by that the development cannot be accommodated in town centres or other sites allocated for such uses

- Continuing to define primary and secondary retail frontages for each centre but allow the market to determine the most appropriate uses for those frontages within Class E

- Encouraging a greater quantity of housing within centres in support of Strategy Option 1: Urban Intensification (including using the brownfield register to define sites in town centres that are considered generally appropriate for residential development)

- Ensuring any large-scale new housing or employment developments create new neighbourhood centres to serve them, or alternatively provide for sustainable connections to existing centres

- Allocating land with town centres or other appropriate locations for new retail and leisure developments